Being an insurance broker can be a tough profession.

Not only do they have to negotiate with insurers and contend with external market forces, but they must facilitate their client’s experience across their insurance journey.

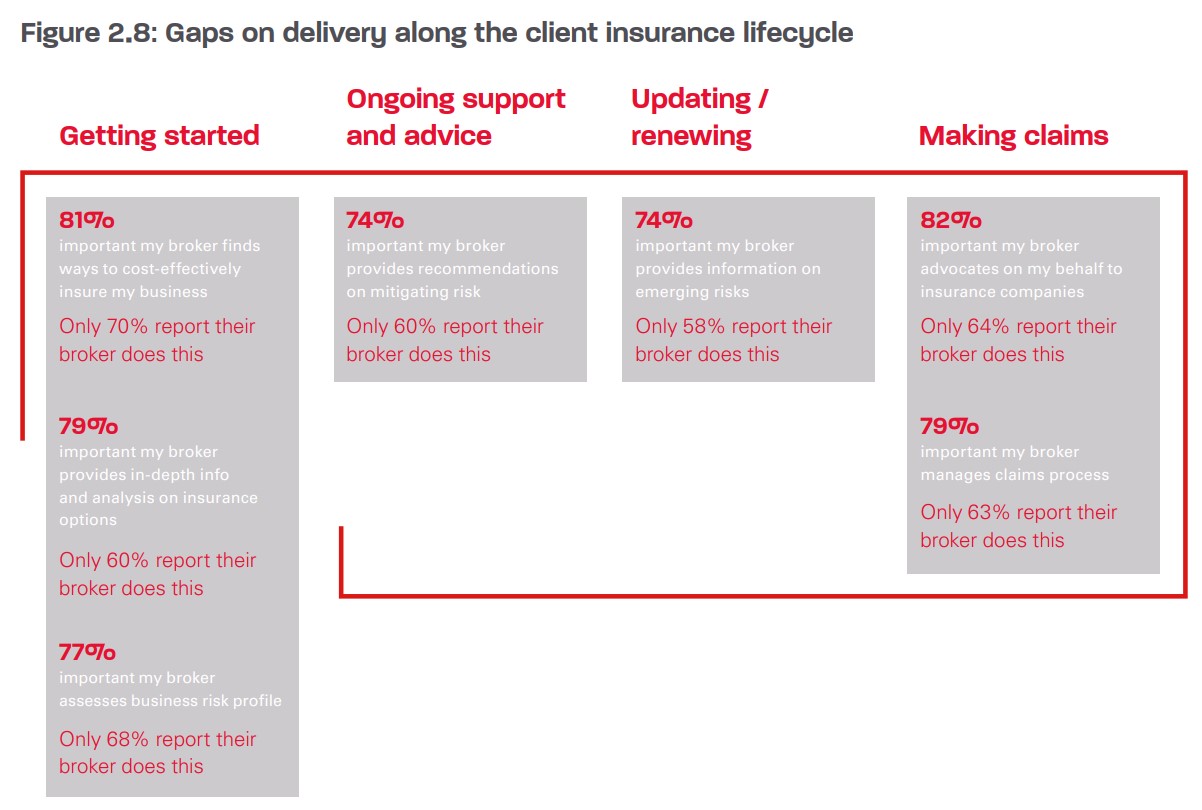

But while the services brokers provide are pivotal to their clients, recent research by Vero has found that there is a clear gap between what brokers deliver compared to their SME client’s expectations across the client insurance lifecycle.

“This research confirms two things,” says Jane Mason, Head of Product, Channels & Risk at BizCover for Brokers.

“Firstly, SME clients value the role of brokers not just at the start or end of their journey but across the whole lifecycle. And secondly and more importantly, that there is a potential gap between client’s expectations and the advocacy brokers can provide in the current environment.”

From initial recommendations and providing ongoing support, to the renewal period and having to make a claim, the above table from the Vero 2022 SME Insurance Index shows how important brokers are to their SME clients.

“What it also says is that there is an opportunity to bridge the gap and Insurtechs can help with that,” says Mason.

Image from the 2022 Vero SME Insurance Index page 23 comparing what broker clients expect from their brokers to what service they actually get.

Getting Started

Just like any relationship, beginnings are essential. It is the time for brokers to lay down expectations for their clients and to show the value in their advice.

Yet nowhere along the client insurance lifecycle is there a greater gap than at the start.

There is an 11% difference between the importance of brokers finding ways to cost-effectively insure their client’s business and what the small business owners think brokers deliver. The gaps in delivery between brokers providing an in-depth analysis of insurance options for their clients (19%) and brokers assessing the business risk profile (9%) are also high.

Now there’s clearly room for improvement. But knowing what challenges brokers face and seeking how to overcome them could help bridge the gap.

Mason says the expectations across all three of these points can be helped by streamlining processes through Insurtechs like BizCover for Brokers.

“Our comparison site gives brokers access to multiple markets and products to compare premiums and coverage instantly and to provide responsive service,” says Mason. “Having multiple quotes from multiple leading insurers on one platform promotes contestability and transparency helping brokers deliver fair and cost-effective pricing to their SME clients.”

The platform also allows brokers to quote and bind multiple policies ad products with single data entry streamlining the broking process. Since many SME clients do not require bespoke solutions, brokers can procure quotes with greater efficiency, leaving more time for advocacy and services.

“What we want is to remove the manual work involved in obtaining quotes and give brokers more time to service their clients.”

Ongoing Support and the Renewal Period

One of the more positive findings of the Vero research is that most SME clients consider the services brokers provide throughout the middle period of the client insurance lifecycle as valuable.

Close to three-quarters (74%) of small business owners consider it important for their broker to provide recommendations on mitigating risk through periods of low activity and at renewal time. Customers also particularly want information about current and emerging risks when updating their policy.

Yet there is a 14% and a 16% gap respectively between what customers think is important and what they find brokers deliver across these important sections of the insurance lifecycle.

“Staying on top of the latest trends is essential, as it allows brokers to open that conversation with clients about the different types of risks they may be exposed to and give the client options to cover themselves,” says Mason.

This is why BizCover for Brokers regularly updates its broker network with the latest market updates through articles, emails and webinars.

Many small businesses that give advice are not covered by PI insurance for instance, according to the insights gathered from B4B’s Small Business Bravery Report.

“The risks associated with cybercrime is another growing concern where lots of SMEs are being targeted, and even the risk of tax audits could be something many businesses haven’t considered yet…We’ve got the resources that’ll help you relay information back to your clients and the platform that’ll help compare and add additional covers.”

Making Claims

The final section of the client insurance lifecycle is arguably the most crucial, at least in the eyes of small business owners.

When a claim arises, small business owners want a broker in their corner.

It’s probably a stressful time in their lives and they want an expert to help them through this process in a clear and efficient manner.

Dealing with a claim is the time for brokers to show their industry knowledge and understanding of their client’s needs.

SMEs also prefer to use the service of brokers during a claim, with 74% of small businesses and 81% of medium-sized businesses saying they would rather use a broker than go direct through an insurer, according to Vero.

Vero’s findings coincide with this sentiment, with 82% of SME clients thinking it’s important that their broker advocates on their behalf to insurance companies. Yet only 64% say their brokers achieve this.

At B4B, brokers have the choice to deal direct with the insurer or to use the support available through our claims team.

“It’s the broker’s decision to manage their clients how they see fit. We can ‘manage’ the claim with the insurer and facilitate the process, assist with communication, pushing for speedy outcomes, reviewing claims decisions and pushing back were needed,” says Jane. “Or we can give you the reigns. We customise our approach according to the desires of the broker.”

The bottom line

It is clear that brokers add value across the entire insurance lifecycle for their SME clients and not just when their getting started or at claims time.

And while there are gaps between the expectations and the delivery of their services, brokers can depend on Insurtechs to help mend the discrepancy

“The problems are identified and brokers now have the opportunity through BizCover for Brokers to capitalise on their gained efficiencies and exceed their client’s expectations.

*The information in this article is general only and should not be relied upon as advice. BizCover for Brokers is a registered business name of BizCover Pty Ltd (ABN 68 127 707 975; AFSL 501769).